Marketers often lean on evidence-based principles from industry and academic studies. The classics, such as the 60:40 brand-to-activation budget split, mental availability, and maximum reach, to name a few, have become essential heuristics that lend marketing strategies structure, simplicity and predictability.In contrast, data-driven marketing can seem disruptive. New tools frequently emerge – attention metrics, universal identifiers, modern marketing mix models, to name a few. Real-time data signals, AI models and automation have brought highly responsive and precise tactics to the marketing toolkit. They continuously promise new, if sometimes unproven ways to grow, engage and retain customers.

The schools of evidence-based and data-driven marketing bring about conflicting approaches. The use of personal data and rapid pace of innovation make the latter unwieldy for industry-wide validation. Yet, sustaining on the slower, longitudinal observations of the former can blind brands to next-generation opportunities. This tension often plays out in audience strategy and targeting. There are the time-tested principles of broad reach, which says it is important to grow mental availability among as many out-of-market customers as possible. Yet, with digital marketing, it is now viable to create compelling customer experiences that compress the discovery-to-purchase cycle. Optimisation algorithms, precise targeting and AI-driven ideation further accelerate and strengthen such activations.

In this article, we review prominent principles from academic research, trends in data-driven marketing, and the tensions between the two. We will discuss practical principles and/or solutions that bridge the divide, especially in strategies pertaining to the selection of media mix and target audiences, and how they apply to different industries. In the process, we’ll explore how scaled precision can become a competitive advantage for driving brand growth in the digital and AI-first era.

Out-of-market customers drive growth

Let’s start with some of the most popular theories from the Ehrenberg Bass Institute (EBI). The 95-5 heuristic suggests that at any given time, 95% of customers are out of market (John Dawes). Future growth, therefore, rests on building mental availability among these customers long before they are ready to purchase. This involves the conquest of category entry points to increase the likelihood of brand recall (and ultimately purchase) when customers enter the market in various buying situations or moments. Finally, the 95-5 heuristic underscores the importance of reaching all potential customers, particularly light buyers, in order for a brand to be top of mind whenever a buying situation arises.

Marketers lack budgets for sufficient cut-through

However, 75% of marketers struggle to commit the budgets needed for advertising cut-through (magic numbers). Without adequate investment, too few audiences are exposed to a campaign often enough to register, remember or discuss it. Marketing returns are highest when advertisers are able to achieve penetration with sufficient reach and frequency. Frequency, in particular, plays a crucial role. During my time in the agency world, we found that repeated exposure is essential to delivering brand lift, and created multiple initiatives to ensure success in achieving optimal frequencies.

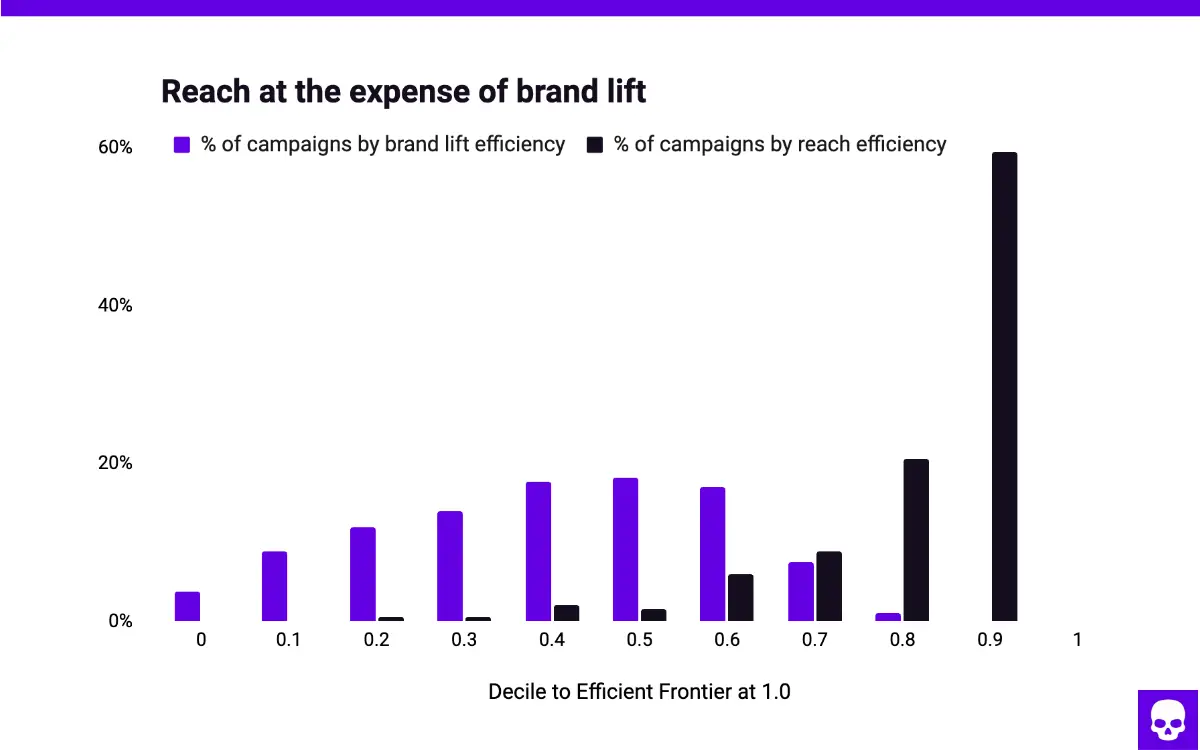

Many prioritise reach at the expense of brand effects

A recent study, Beyond the Pair: Media Archetypes and Complex Channel Synergies in Advertising, analysed 557 global brands and revealed a crucial imbalance in marketing media mixes. While 80% of brands ranked in the top two tiers of reach efficiency, only 8% achieved the top two tiers of brand lift (Oxford, figure A). This suggests that while the principle of broad reach (EBI) is widely applied by marketers, reach alone does not guarantee brand growth. While brand lift is inherently scarce, and much harder to attain than reach, the gross overweight on the latter signals a need to reconfigure strategies for stronger brand effects, especially when faced with limited budgets.

Figure A – Data from “Beyond the Pair: Media Archetypes and Complex Channel Synergies in Advertising”

Channel selection matters when delivering brand effects

Seven popular media mix archetypes were discovered in the same study (Beyond the Pair, Oxford). Each archetype was found to deliver different brand effects at varying degrees of success. For example, heavy-ing up on traditional newspaper and radio channels provides a higher success rate of driving lower levels of brand lift. On the other hand, prioritising YouTube with other algorithmic digital channels provides higher brand lifts, albeit more inconsistently so.

The optimal media mix also differs by industry. In the CPG sector, combining TV, outdoor and Facebook was found to deliver multiple brand goals effectively. In contrast, technology companies require different strategies to improve brand awareness, association or purchase intent. This makes sense as digital products are often immediate, free and/or directly distributed through advertising. Meanwhile, to compete effectively across physical and digital retail environments, omnichannel visibility is required to create strong brand presence.

This finding highlights how different channels uniquely contribute to brand effects. By understanding their individual and/or combined contributions, as we’ve outlined in modern measurement, marketers can arrive at optimal media mixes for delivering specific brand and business outcomes. Less blind reach and more brand growth.

Attention signals ensure ads are noticed (and processed)

The fight for consumer attention has never been more intense. Advertising channels continue to expand with the exponential growth of connected TV and retail media networks as well as agentic search entering the fray this year. Attention spans have shrunk, and rapid context switching is now the norm, making it harder for brands to rise above the noise.

As ad blindness worsens, attention signals have become a prerequisite for measuring digital advertising cut-through. By now, multiple industry and media agency studies have shown that attention is also a strong predictor of brand and business outcomes. After all, “without noticing, there is nothing” (EBI). Signals including but not limited to eye-tracking, dwell-time, and ad size help marketers filter for higher quality placements in an increasingly cluttered digital environment.

Of note, 9x more attentive time is needed to lift purchase intent compared to brand awareness (Lumen). This makes sense given that consumers expend heavier cognitive loads when exploring and evaluating a product for purchase. Marketers who can help reduce cognitive load by streamlining the evaluation process win more often (Google).

Targeting poised for a renewed, more important role

Targeting’s contribution to incremental sales grew over a 6 year period to 11% in 2023, placing it right behind creative and brand size factors. It is worth noting that this growth took place despite a significant decrease in user-level targeting signals from more stringent privacy and platform regulations.

Meanwhile, nearly 8 in 10 companies are investing in privacy and first-party data (IAB) in order to preserve and improve audience addressability. The result is more privacy-centric solutions that take advantage of consented first-party data from both publishers and advertisers. For example, universal IDs can encrypt consented hashed emails to make them available for advertising use across the open web. Contextual targeting is also improving with advances in LLM, which identifies more semantically relevant placements than keyword or domain-based targeting tactics.

Third-party identifiers will get the fate it deserves in 2025. 90% of the browser market share could become cookieless long-term, from either fully blocking or allowing users to opt-out from third-party cookies (eMarketer). The good news is that highly inaccurate third-party data (Neumann) will be replaced by a new wave of solutions that bring richer signals and privacy-safe means to reach authentic audiences. As they mature, we can expect targeting’s contribution to both brand and sales effects to further improve.

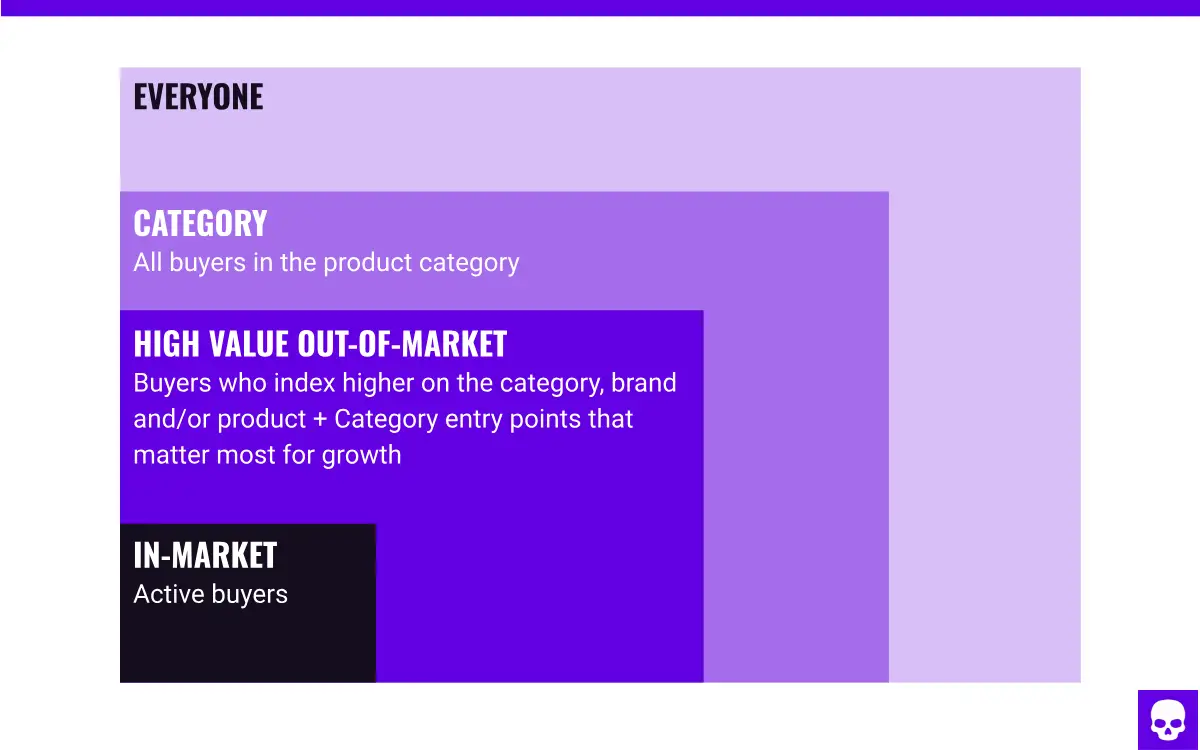

An effective targeting water waterfall

Figure B – Enhanced audience waterfall

Marketers often make trade-offs between unaffordable mass reach and overly niche, expensive targeting. While broad reach addresses the entire addressable market, it can be inefficient. On the other hand, hyper-targeting can lead to overspending on smaller segments that result in unsustainable growth. A strategic middle ground can exist between the two extremes. It lies in high-value audiences who are more likely to be influenced by campaigns for a given category, brand or product. These audiences are also right-sized to ensure sufficient reach and frequency exposure for a given budget, giving marketers the best chance of maximising brand effects.

Through both client work and publicly available studies, we’ve seen how targeting these high-value audiences outperforms broad reach, category-level segmentation, demographic targeting and retargeting strategies (Transunion, Google Marketing). Identifying these segments requires insights that map multiple dimensions, from geographical markets, product categories, attitudes and behavioural traits to key indicators such as brand lift and buyer propensities. By using diverse data sources, such as surveys, web/app analytics, CRM data and industry partnerships, marketers can pinpoint to heterogeneities that exist in the market, and right-size segments for maximum impact.

A common misstep is the overemphasis on demographics, which has become insufficient in describing the complexities of the modern consumer. Studies have shown that there is as much diversity in attitudes and behaviours within each demographic as there is across them. This explains why focusing solely on demographics commonly results in generic insights and campaign ideas.

Another misconception is the over-reliance on loyalty marketing. While loyalty programmes are now a mainstay for many brands, research consistently shows that brand penetration is the more important lever, contributing up to 2.7x higher growth than loyalty marketing (Binet & Field). This contrasts with the finding that brands are spending only 19.6% more on acquisition than retention (CMO Survey), suggesting there is ample headroom for optimisation. This further aligns with the need for brands to grow big enough, so they are penalised less by the double jeopardy law (EBI), which states that brands with smaller market share have buyers that are slightly less loyal.

Conclusion

As Clayton Christensen observes in The Innovator’s Dilemma, many companies fail not because they lack resources but because they over-prioritise established methods at the expense of innovation, leaving them vulnerable to disruption. In marketing, this tension between evidence-based principles and new data-driven strategies have grown sharper as media channels diversify, attention wanes and innovations unlock better targeting and measurement.

Mental availability and broad reach remain essential, but studies now demonstrate ample opportunities for better media mix selection, attention optimisation and audience targeting. Scaled precision will be vital to achieving these aims, enabling marketers to make well-informed choices. By balancing proven marketing principles with the latest data-driven methods, brands can adapt more quickly to the evolving media and technology landscape. In doing so, they stay ahead of disruption, and secure a far more resilient path to enduring growth.